Okay, here's an article addressing the prompt "How to Make Money on Maternity Leave? What are My Options?" written from the perspective of a financial investment advisor.

Maternity leave is a significant period in a woman's life, a time dedicated to nurturing a newborn and adjusting to a new family dynamic. However, it often comes with financial considerations, as income may be reduced or completely absent while expenses simultaneously increase. Navigating this financial landscape requires careful planning and a proactive approach to supplementing income during this period. While prioritizing the well-being of yourself and your child is paramount, exploring avenues to generate income can alleviate financial stress and contribute to long-term financial stability. Let’s delve into some viable options, considering varying levels of time commitment and expertise.

One of the first avenues to explore is maximizing available employer benefits and government assistance programs. Thoroughly understand your employer's maternity leave policy, including paid leave provisions, short-term disability benefits, and any other financial support offered. In many countries, government-funded programs provide financial assistance to new parents, albeit often with specific eligibility requirements. Researching and applying for these programs is crucial, as they can provide a valuable financial cushion during your leave.

Beyond traditional benefits, consider leveraging existing skills and experience to generate income through freelance work. The digital landscape offers numerous opportunities for remote work, allowing you to set your own hours and manage your workload around your baby's schedule. If you have a background in writing, editing, graphic design, web development, or social media management, platforms like Upwork, Fiverr, and Freelancer.com can connect you with potential clients. The key is to identify your marketable skills and tailor your services to meet the needs of businesses seeking remote assistance. Furthermore, consider tasks such as virtual assistant work, translation, or online tutoring, all of which offer flexibility and can be performed from home. It's important to realistically assess the time you can dedicate to freelance work while caring for a newborn. Start with smaller projects and gradually increase your workload as you become more comfortable managing your responsibilities.

Another avenue worth exploring is passive income streams. While building a passive income stream typically requires upfront effort, the long-term benefits can be substantial. One option is to create and sell digital products, such as e-books, online courses, templates, or stock photos. If you have expertise in a particular area, sharing your knowledge through digital products can generate recurring income with minimal ongoing effort. Platforms like Teachable, Udemy, and Etsy provide tools and resources for creating and selling digital products. Another passive income strategy is affiliate marketing, where you promote other companies' products or services and earn a commission on each sale made through your unique affiliate link. This requires building an audience and selecting products that align with your niche, but it can be a lucrative source of passive income once established. Consider starting a blog or a social media page where you can share your expertise and promote relevant products.

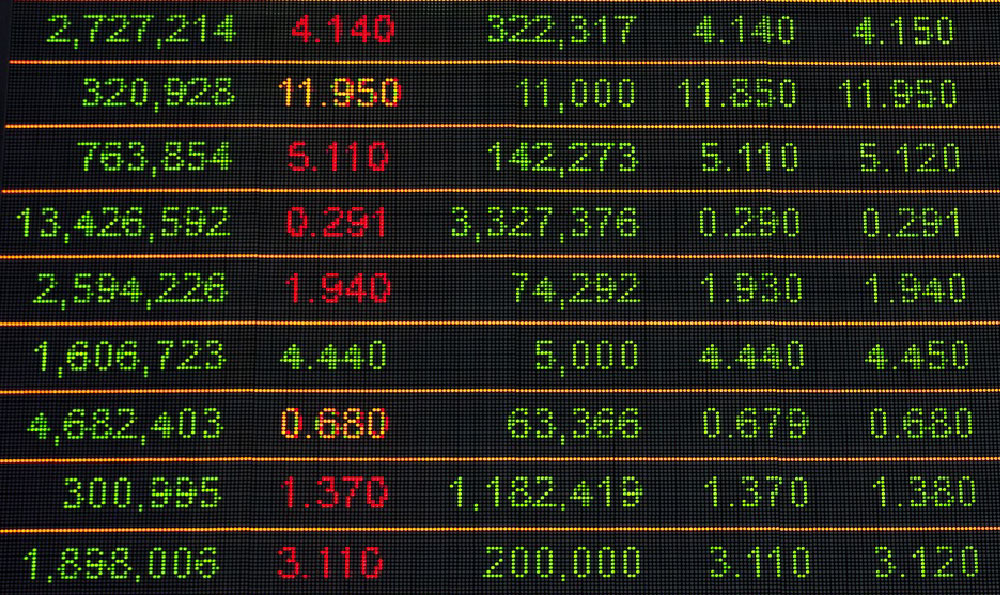

Investing in dividend-paying stocks or real estate investment trusts (REITs) is another way to generate passive income. Dividend stocks pay out a portion of their profits to shareholders on a regular basis, providing a steady stream of income. REITs invest in real estate and distribute a significant portion of their income to shareholders in the form of dividends. While these investments carry some risk, they can provide a reliable source of income over the long term. Before investing, it's important to conduct thorough research and understand the risks involved. Consider consulting with a financial advisor to determine the appropriate asset allocation for your individual circumstances. It is also worthwhile to explore high-yield savings accounts or certificates of deposit (CDs). While returns might be modest compared to riskier investments, they provide a safe and predictable source of income.

Monetizing a hobby can be a rewarding and fulfilling way to generate income during maternity leave. If you enjoy crafting, baking, photography, or any other creative activity, consider selling your creations online. Platforms like Etsy and Shopify provide easy-to-use tools for setting up an online store and reaching a wider audience. You can also sell your products at local farmers' markets, craft fairs, or community events. Word-of-mouth marketing and social media promotion can be effective ways to attract customers and build your brand. Make sure to price your products competitively and provide excellent customer service.

In the modern era, social media platforms offer opportunities to monetize content creation. If you enjoy creating videos, writing blog posts, or sharing your thoughts on social media, you can potentially earn income through advertising, sponsorships, or affiliate marketing. Building a strong following and creating engaging content are essential for success. Consider focusing on a specific niche, such as parenting, cooking, or fitness, to attract a targeted audience. Remember that building a social media presence takes time and effort, but it can be a rewarding way to generate income while pursuing your passions.

Furthermore, look at the possibility of renting out assets you aren’t actively using. If you own a spare room, a vacation home, or even a car, consider renting it out through platforms like Airbnb or Turo. This can provide a significant source of income with relatively little effort. Just be sure to factor in the costs of maintenance, insurance, and cleaning when setting your rental rates. Also, thoroughly research local regulations and insurance implications before listing your property or vehicle for rent.

Before embarking on any income-generating venture, it's crucial to consider the tax implications. Income earned during maternity leave is generally taxable, so it's important to keep accurate records and consult with a tax professional to ensure compliance with tax laws. Deductible expenses related to your business or freelance work can help reduce your tax burden. Plan your finances and understand the implications to avoid surprises during tax season.

Finally, remember that the primary focus during maternity leave is caring for yourself and your newborn. Prioritize your health and well-being, and don't overextend yourself with income-generating activities. Set realistic goals, manage your time effectively, and seek support from your partner, family, and friends. Maternity leave is a temporary period, and your long-term financial goals should guide your decisions. It is okay to not monetize this time, but understanding that there are options should you desire some extra income can be beneficial. It’s about finding a balance between caring for your child and supplementing your income in a way that works for you and your family.