How to Make Money at Home with No Investment: A Strategic Guide to Passive Income and Smart Risk Management

The concept of generating wealth while staying at home has become increasingly appealing, especially for those looking to avoid the risks associated with traditional investments. While the allure of cryptocurrency often revolves around high stakes and significant capital, it is possible to explore alternative avenues within this domain that require minimal or no upfront investment. From leveraging digital tools to tapping into niche markets, the strategies outlined here aim to guide individuals toward sustainable financial growth without exposing them to unnecessary risks.

One of the most accessible methods involves capitalizing on the digital infrastructure that enables passive income streams. For instance, creating and monetizing content on platforms like YouTube, podcasts, or social media can generate revenue with minimal financial outlay. By focusing on in-demand topics such as cryptocurrency, blockchain technology, or financial literacy, individuals can build a following that translates into earnings through advertisements, sponsorships, or affiliate marketing. This approach not only allows for income generation from home but also provides an opportunity to educate others on the subject, fostering trust and long-term profitability.

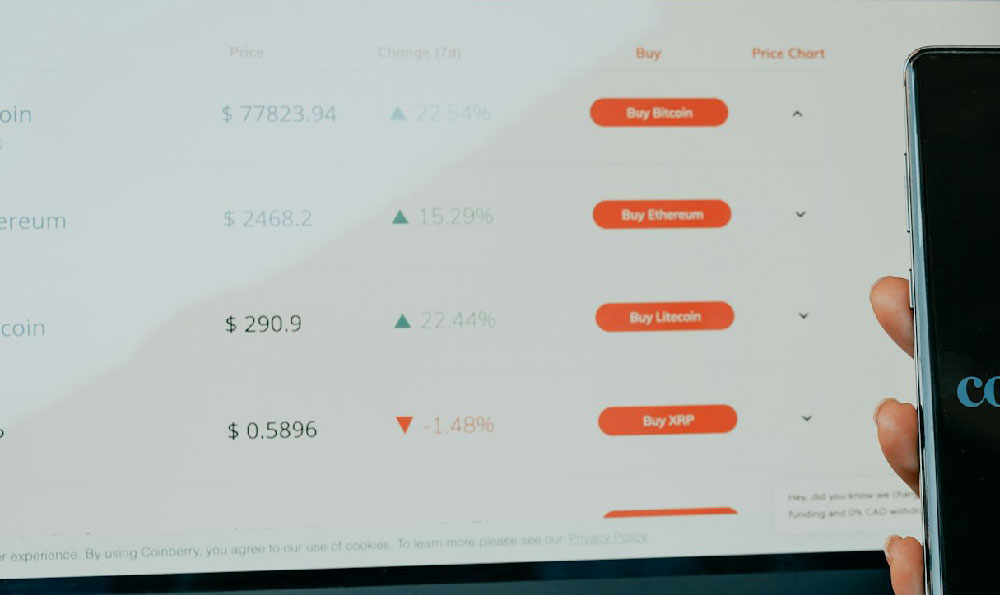

Another promising avenue lies in the field of freelancing and remote work. Platforms such as Fiverr, Upwork, or Toptal connect skilled professionals with clients globally, enabling individuals to earn money in their spare time without requiring substantial capital. Offering services like crypto trading analysis, market research, or even basic financial advice can be lucrative, especially for those with niche expertise. The key here is to develop a portfolio that demonstrates value and reliability, ensuring that clients are willing to pay for your skills. Additionally, leveraging crypto-enabled payment systems such as Bitcoin or Ethereum can streamline transactions and reduce fees, making this method even more appealing for those seeking to minimize costs.

The rise of decentralized finance (DeFi) and automated trading platforms also presents opportunities for generating income without direct investment in assets. DeFi protocols allow users to earn rewards by staking or providing liquidity to blockchain networks, often without the need to purchase or manage digital currencies. These platforms operate on smart contracts, ensuring that users receive returns automatically while avoiding the complexities of market timing. Similarly, algorithmic trading platforms powered by AI can execute trades on behalf of users, potentially generating profits through market fluctuations. These systems often require little to no initial investment, as they function through borrowed funds or community contributions, making them a viable option for those with limited capital.

For those interested in cryptocurrency but wary of high-risk ventures, participating in peer-to-peer (P2P) trading or lending can be an alternative. P2P platforms allow individuals to trade or lend their crypto holdings to others, often receiving interest or fees for their involvement. This method requires no significant investment, as individuals can start with small amounts of cryptocurrency and gradually expand their portfolio. Additionally, lending platforms like Celsius or BlockFi enable users to earn passive income by allowing others to borrow their digital assets, with returns generated through interest rates. These platforms often offer competitive rates, making them an attractive option for those seeking to optimize their income without substantial risk exposure.

However, it is crucial to approach these opportunities with a clear understanding of the associated risks. Many platforms that promise high returns without investment operate with minimal oversight, increasing the likelihood of fraud or unreliable performance. To mitigate this, individuals should conduct thorough research on the platform’s reputation, security measures, and user feedback before committing to any financial activity. Additionally, diversifying income streams across multiple platforms can reduce reliance on a single source, ensuring financial stability even if one avenue underperforms.

A strategic mindset is also essential. Instead of chasing quick profits, focus on long-term goals such as building a passive income portfolio through consistent effort. For example, creating a crypto-related blog or YouTube channel requires time and skill development, but the returns can be substantial once the audience is established. Similarly, freelancing in cryptocurrency-related fields can lead to recurring income if the quality of work is consistently high, as clients are likely to return for repeat services.

Finally, the importance of continuous learning cannot be overstated. Staying updated on market trends, technological advancements, and regulatory changes is vital for making informed decisions. For instance, understanding the dynamics of market cycles, such as bull and bear phases, can help individuals time their entries and exits more effectively. Additionally, familiarizing oneself with key technical indicators—such as moving averages, RSI, and volume analysis—can provide insights into potential market movements, enabling more precise decision-making.

In conclusion, the possibility of making money at home without significant investment lies in the intersection of digital tools, niche markets, and strategic planning. By exploring options such as content creation, freelancing, DeFi staking, or P2P lending, individuals can generate income while minimizing risks. However, success in these endeavors requires a combination of caution, education, and long-term vision, ensuring that financial growth is both sustainable and secure.