Keith Gill, a prominent figure in the world of retail investing, has become a household name over the past decade due to his significant role in the "GameStop rally" of 2020-2021, a movement that sparked widespread attention to the power of individual investors and social media influence in financial markets. While his financial journey has been the subject of both admiration and scrutiny, the exact amount he earned in 2024 remains elusive, as public financial disclosures for high-profile investors are often limited or non-existent. However, by examining his career trajectory, investment strategies, and the broader context of his activities, we can construct a plausible understanding of his 2024 financial standing and the factors that may have shaped it.

Gill’s initial rise to fame was tied to his participation in the Reddit stock forum r/WallStreetBets, where he gained traction by advocating for the purchase of GameStop (GME) shares amid a market downturn. This ultimately led to a dramatic short squeeze, causing the stock price to skyrocket and drawing millions of retail investors into the fray. During this period, Gill’s net worth surged, with estimates suggesting he could have amassed tens of millions of dollars. However, as the market eventually corrected, the value of his holdings declined, and his subsequent efforts to navigate the shifting landscape have been a subject of ongoing interest.

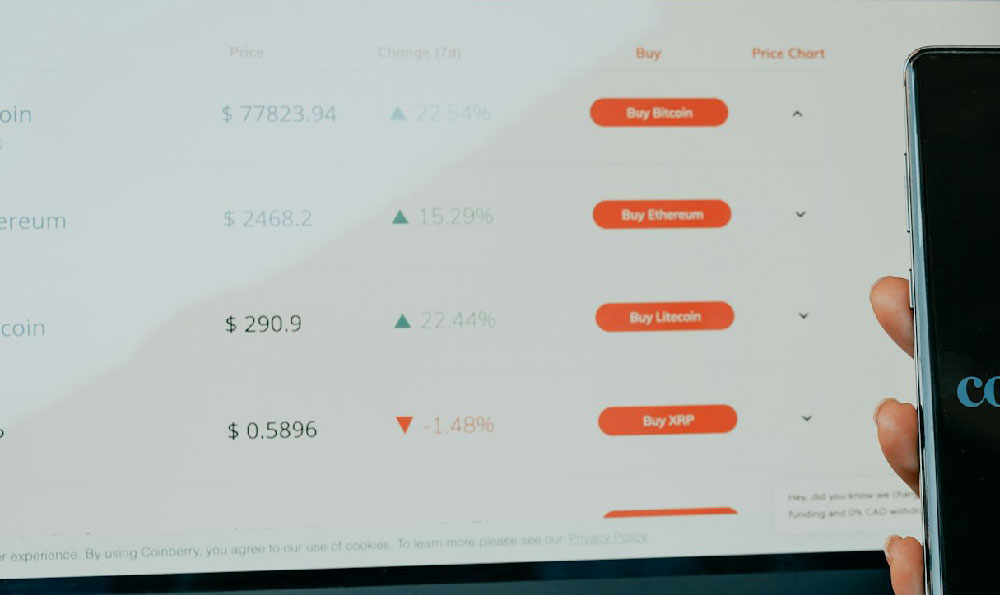

In the years following the GameStop event, Gill transitioned from a full-time retail trader to a more diversified role as an investor, writer, and public speaker. His income now likely stems from multiple avenues, including stock trading, investment in other assets, content creation through his blog and social media platforms, and potential earnings from speaking engagements or media appearances. The 2024 timeframe, however, complicates matters, as the stock market has experienced a mix of volatility and trends influenced by global economic factors, interest rate fluctuations, and technological advancements. Gill’s ability to adapt to these conditions would have played a critical role in determining his earnings for that year.

One key aspect of Gill’s financial strategy is his emphasis on long-term value investing, a shift from the short-term speculation that initially defined his public persona. This approach would have positioned him to benefit from sustained growth in certain sectors or stocks, potentially leading to more substantial gains. However, the effectiveness of this strategy depends on market performance, and 2024 saw mixed results for many stocks. For instance, the tech sector faced challenges due to concerns over AI investment bubbles and regulatory scrutiny, whereas traditional industries such as finance and energy experienced relative stability or growth. Gill’s portfolio might have been diversified across these sectors, which could have mitigated risks but also limited overall returns.

Another factor influencing Gill’s earnings is the continued relevance of his brand and online influence. As a public figure, his activities on social media and in the investment community likely generate residual income from brand partnerships, sponsored content, or a loyal following that may invest in his recommended strategies. Additionally, his ventures into writing, such as books or articles, and his participation in webinars or podcasts, could contribute to a steady income stream. The challenge, however, lies in quantifying these contributions without access to specific financial records, as they are often less transparent than traditional forms of income.

The broader economic environment in 2024 would have also impacted Gill’s financial outcomes. Global markets were influenced by the lingering effects of inflation, central bank policies, and geopolitical tensions. For example, the Federal Reserve’s interest rate decisions in 2024 might have affected the performance of stocks and bonds, while macroeconomic factors such as supply chain disruptions or shifts in consumer behavior could have influenced the value of his holdings. Gill’s ability to analyze these macroeconomic trends and integrate them into his investment decisions would have been crucial to his success.

Beyond his personal earnings, Gill’s story serves as a case study for understanding the dynamics of retail investing and the risks associated with it. While his early success demonstrated the potential for individual investors to achieve significant returns through strategic decision-making and community-driven insights, the subsequent market corrections highlighted the importance of risk management and adaptability. For instance, the rapid rise and fall of GME in 2021 showed how volatile markets can be, and Gill’s subsequent efforts to build a more stable investment approach reflect an awareness of these risks.

In terms of long-term financial goals, Gill’s accumulation of wealth over the years suggests a focus on compounding returns and diversification. His net worth, which was estimated to have reached over $100 million at its peak, could have been further augmented through reinvesting profits, capitalizing on market opportunities, and expanding his business ventures. However, the exact figures for 2024 would require a detailed analysis of his portfolio performance, which is not publicly available.

For investors looking to emulate Gill’s success, the lesson extends beyond chasing short-term gains. It involves developing a deep understanding of financial markets, maintaining discipline in investment decisions, and continuously refining one’s strategy to adapt to changing conditions. The 2024 market, like any other, presents opportunities for those who can navigate its complexities with informed decisions.

In conclusion, while Keith Gill’s exact earnings for 2024 cannot be determined with certainty, his financial journey offers valuable insights into the potential of individual investors and the importance of strategic, diversified approaches. His ability to evolve from a retail trader to a multifaceted financial influencer underscores the adaptability required in the world of investing. For those seeking to build their own financial path, Gill’s story serves as both an inspiration and a cautionary tale, emphasizing the need for knowledge, resilience, and a long-term perspective.