VTI, Vanguard Total Stock Market ETF, represents a cornerstone investment for many seeking broad market exposure within their portfolios. Determining whether it's a "good" investment requires understanding its core attributes, the benefits it offers, and how it aligns with an individual investor's specific financial goals and risk tolerance. Further, knowing how to invest in VTI effectively is crucial for maximizing its potential within a broader investment strategy.

VTI's appeal lies in its comprehensive representation of the U.S. stock market. It aims to track the performance of the CRSP US Total Market Index, encompassing a vast array of companies, from the largest mega-caps to smaller, emerging businesses. This breadth offers immediate diversification, mitigating the risks associated with investing in individual stocks or sector-specific funds. Instead of betting on the success of a select few companies, VTI provides exposure to the overall health and growth of the American economy. This diversification is particularly valuable for novice investors or those seeking a simplified approach to market participation.

One of the key advantages of VTI is its low expense ratio. Vanguard is known for its commitment to low-cost investing, and VTI exemplifies this principle. The expense ratio, representing the annual cost of owning the fund, is remarkably low, typically around 0.03%. This means that for every $10,000 invested, you'll pay just $3 in annual fees. This seemingly small difference can accumulate significantly over time, especially when compared to actively managed funds with higher expense ratios that may or may not outperform the market. The low cost allows more of your investment returns to compound and grow over the long term.

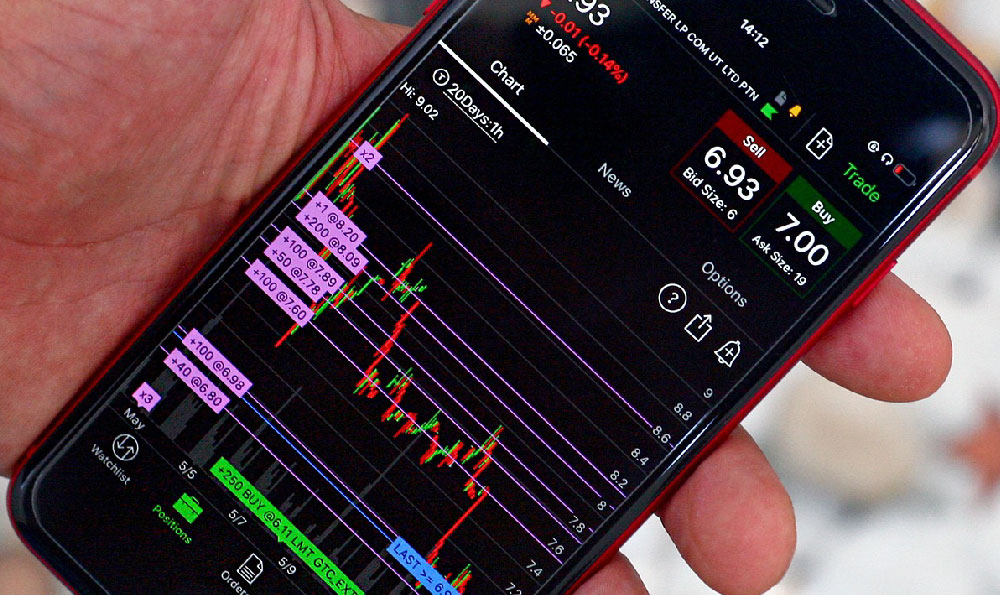

VTI also benefits from its liquidity and transparency. As an ETF, it trades like a stock on major exchanges, allowing investors to buy and sell shares throughout the trading day. This provides flexibility and access to your investment when needed. Furthermore, the holdings of VTI are publicly available, providing transparency into the composition of the fund. Investors can see the top companies held within the ETF and understand the overall market exposure they are receiving.

However, like any investment, VTI is not without its potential drawbacks. While its broad diversification mitigates some risks, it also means that VTI will inherently be subject to market volatility. Economic downturns or periods of market correction will impact VTI's performance, and investors should be prepared for potential short-term losses. Therefore, a long-term investment horizon is generally recommended for VTI. Short-term traders seeking quick profits may find its broad market exposure less appealing than more volatile, specialized investments.

Another consideration is that VTI is market-cap weighted. This means that the fund's holdings are weighted based on the market capitalization of the underlying companies. Larger companies will have a greater influence on the fund's performance than smaller companies. While this reflects the overall market, it also means that VTI's returns may be skewed towards the performance of the largest corporations. Some investors may prefer to allocate a portion of their portfolio to small-cap or mid-cap funds to diversify their exposure beyond the largest companies.

Now, considering how to invest in VTI: several avenues are available to investors. The most common method is through a brokerage account. Most major brokerage firms offer commission-free trading of ETFs like VTI, making it an accessible investment for individuals with varying investment amounts. You'll need to open an account, fund it with cash, and then place an order to buy shares of VTI. Brokerage accounts can be either taxable accounts or retirement accounts like IRAs or 401(k)s, depending on your investment goals and tax situation.

Another option is through robo-advisors. Robo-advisors are automated investment platforms that create and manage portfolios based on your risk tolerance, financial goals, and time horizon. Many robo-advisors utilize ETFs like VTI as core components of their portfolios, providing a hands-off approach to investing. While robo-advisors typically charge a small management fee, they offer the convenience of automated portfolio management and rebalancing.

Direct purchase through Vanguard is also possible, though generally more advantageous for long-term investors with substantial assets. Vanguard may offer reduced fees or additional services for larger accounts.

When investing in VTI, it's crucial to consider your asset allocation strategy. VTI can serve as a core holding in a diversified portfolio, but it shouldn't be the only investment. Depending on your risk tolerance and financial goals, you may want to complement VTI with other asset classes like bonds, real estate, or international stocks. A well-diversified portfolio can help mitigate risk and potentially enhance long-term returns.

Dollar-cost averaging is a popular strategy for investing in VTI. This involves investing a fixed dollar amount at regular intervals, regardless of the share price. This approach can help reduce the risk of investing a large sum at the wrong time. When the share price is low, you'll buy more shares, and when the share price is high, you'll buy fewer shares. Over time, this can smooth out your average cost per share and potentially improve your returns.

Finally, it's essential to rebalance your portfolio periodically. Over time, the allocation of your assets may drift away from your target allocation due to market fluctuations. Rebalancing involves selling some assets that have performed well and buying assets that have underperformed to restore your portfolio to its original allocation. This helps maintain your desired level of risk and ensures that you are staying on track towards your financial goals.

In conclusion, VTI is generally considered a good investment for those seeking broad exposure to the U.S. stock market at a low cost. Its diversification, liquidity, and transparency make it an attractive option for both novice and experienced investors. However, it's crucial to understand its limitations and to incorporate it into a well-diversified portfolio that aligns with your individual financial goals and risk tolerance. By carefully considering your investment strategy and utilizing techniques like dollar-cost averaging and rebalancing, you can maximize the potential of VTI to help you achieve your financial objectives.