As a stay-at-home mom, balancing the demands of family care with the desire for financial independence can feel like a tightrope walk. The digital age has introduced opportunities that allow individuals to generate income from the comfort of their homes, and the cryptocurrency market offers a unique avenue for this. However, navigating this landscape requires more than just curiosity—it demands strategic decision-making, risk awareness, and a clear understanding of how to leverage modern tools without compromising personal well-being. Here’s a comprehensive exploration of how virtual currencies and other investment strategies can become a viable option for women seeking to build financial resilience while managing their domestic responsibilities.

Cryptocurrency has evolved beyond being a speculative asset, offering diverse ways to monetize time and expertise. For instance, staking digital assets like Ethereum or Cardano allows users to earn passive income by supporting network operations, often requiring minimal active involvement. This is particularly appealing for stay-at-home moms who may not have the bandwidth for full-time trading. However, it’s crucial to recognize that staking demands technical knowledge about blockchain protocols, wallet security, and the risks associated with holding digital assets. A beginner might start with user-friendly platforms such as Binance or Coinbase, which offer staking options with lower entry barriers and educational resources. Before committing, research the annual percentage yield (APY) of different assets, the potential for volatility, and the importance of selecting a trustworthy exchange. Remember, even passive income streams can fluctuate, and the market’s unpredictability means a diversified approach is essential.

Another avenue is decentralized finance (DeFi), a sector that enables users to participate in lending, borrowing, and yield farming without relying on traditional financial institutions. PoolTogether and Aave are platforms where users can deposit crypto and earn interest on their holdings. This can be a great way to utilize idle cryptocurrency while managing time constraints. Yet, DeFi carries risks like impermanent loss and smart contract vulnerabilities. To mitigate these, start with low-risk protocols such as stablecoin-based lending platforms, and prioritize protocols with strong security audits and transparent governance. Additionally, staying updated on the DeFi ecosystem through forums, social media, and crypto news sites can help identify opportunities and protect against scams.

For those who prefer a more hands-on approach, participating in the creation of digital assets. For example, freelance work in programming, graphic design, or content creation can be done remotely. Platforms like Upwork, Fiverr, and GitHub allow women to monetize their skills in the crypto space. However, this requires building a professional portfolio and maintaining a steady stream of clients. To succeed, identify in-demand skills, such as blockchain development or crypto marketing, and create a network of contacts through online communities and social media. It’s also vital to set clear boundaries between work and family time, as the flexibility of remote work can blur the lines between personal and professional responsibilities.

Furthermore, the rise of blockchain-based crowdfunding platforms has made it easier for individuals to invest in ventures that align with their interests. Women can contribute funds to startups or projects through tokens, potentially earning returns if the venture succeeds. To navigate this, conduct thorough due diligence on the project’s team, roadmap, and use cases. Platforms like Kickstarter and Indiegogo offer a range of projects, but for crypto-specific ventures, consider DeFi projects or NFT-based initiatives. Always assess the risk level based on the project’s maturity and the potential for market fluctuations.

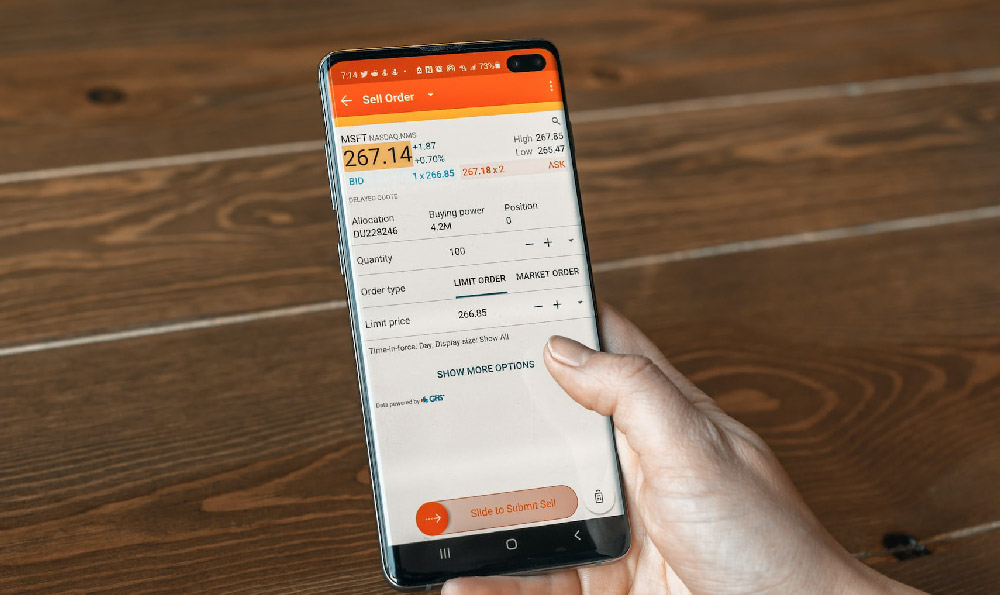

The intersection of virtual coin investments and traditional financial methods also presents opportunities. For example, using cryptocurrency to invest in stocks or real estate through platforms like Robinhood or BlockFi. This allows for portfolio diversification, reducing the risk associated with relying solely on crypto. However, it’s important to understand the tax implications of such investments and to maintain a long-term perspective. By allocating a portion of their budget to crypto and another to traditional assets, women can benefit from the growth potential of both markets while managing risk more effectively.

Lastly, the importance of education cannot be overstated. Investing in virtual assets requires a deep understanding of market trends, technical indicators, and the broader economic factors affecting crypto. Women can start by following reputable sources such as CoinDesk, CoinTelegraph, and Cointelegraph for market analysis. Additionally, learning about fundamental analysis, such as project whitepapers and market capitalization, can help make more informed decisions. As with any investment, the key to success lies in continuous learning, careful planning, and a disciplined approach to managing both finances and time. By combining these elements, stay-at-home moms can explore new avenues for financial growth while maintaining the stability of their household responsibilities.