Making money is a fundamental pursuit that drives individuals and economies alike. It's not merely about accumulating wealth, but also about achieving financial security, pursuing passions, and contributing to society. The paths to financial gain are varied and often require a combination of strategic planning, risk assessment, and diligent execution. Understanding the landscape of potential income streams is the first crucial step in navigating this journey.

One of the most traditional and reliable methods of generating income is through employment. Securing a job that aligns with your skills, interests, and career goals provides a steady paycheck and a foundation for financial stability. Within the realm of employment, there are numerous avenues to explore. Consider pursuing higher education or specialized training to enhance your earning potential in a high-demand field. Negotiating salaries and benefits effectively can significantly impact your income. Moreover, seeking promotions and taking on challenging projects demonstrate your value to the company and open doors to greater responsibility and compensation. However, relying solely on a single source of employment income may leave you vulnerable to economic downturns or company layoffs. Therefore, diversifying your income streams is a wise strategy.

Beyond traditional employment, entrepreneurship presents a potentially lucrative, although often riskier, pathway to wealth creation. Starting your own business allows you to leverage your skills, passions, and innovative ideas to create products or services that address market needs. This can range from launching a small online store to developing a groundbreaking technology. The benefits of entrepreneurship include the potential for significant financial rewards, autonomy over your work life, and the satisfaction of building something from the ground up. However, entrepreneurship also requires significant dedication, financial investment, and a willingness to embrace uncertainty and failure. Thorough market research, a robust business plan, and a strong understanding of financial management are essential for entrepreneurial success. Securing funding through loans, investors, or personal savings is also a critical aspect of launching and scaling a business.

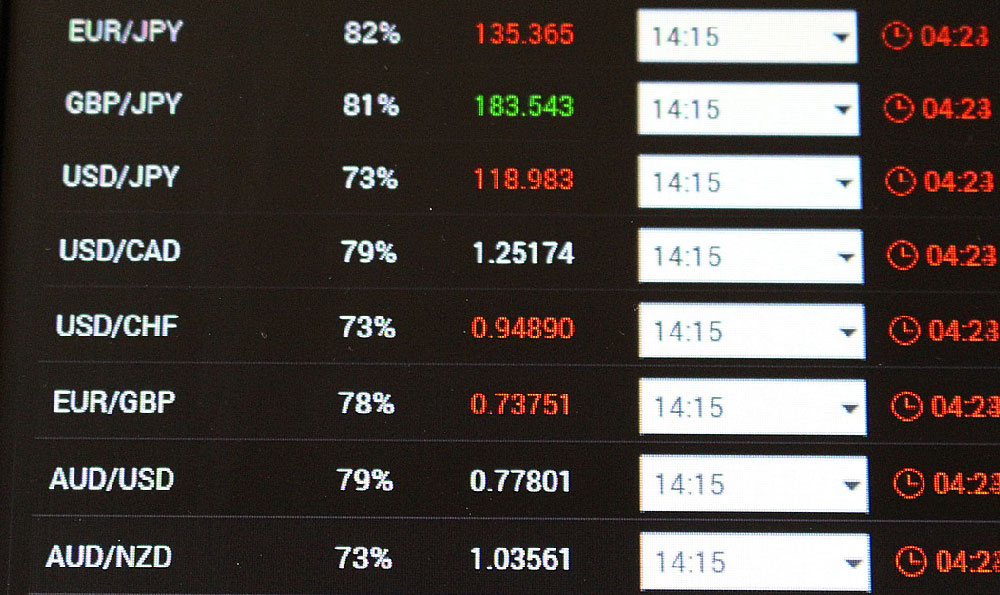

Investing is another powerful tool for building wealth over time. Investing involves allocating capital to assets with the expectation of generating future income or appreciation. The stock market, for example, offers opportunities to invest in publicly traded companies, potentially benefiting from their growth and profitability. However, the stock market also carries inherent risks, as prices can fluctuate significantly based on economic conditions, company performance, and investor sentiment. Diversifying your investments across different sectors, industries, and asset classes can help mitigate these risks. Bonds are another type of investment that typically offers lower returns but also lower risk compared to stocks. Bonds represent loans made to governments or corporations, and they provide a fixed income stream over a specified period. Real estate investing can also be a lucrative avenue, but it requires substantial capital and carries its own set of challenges, such as property management and market volatility. Before investing in any asset class, it is crucial to conduct thorough research, understand your risk tolerance, and seek advice from a qualified financial advisor.

Another growing area for making money is through freelancing and the gig economy. Platforms like Upwork, Fiverr, and TaskRabbit connect individuals with short-term projects and freelance opportunities across a wide range of skills, from writing and graphic design to programming and virtual assistance. Freelancing offers flexibility and control over your work schedule, but it also requires self-discipline, marketing skills, and the ability to manage your own finances and taxes. Building a strong online presence and developing a portfolio of successful projects are essential for attracting clients and securing lucrative freelance gigs.

In addition to these more conventional methods, there are emerging opportunities for generating income in the digital age. Content creation, for example, has become a significant source of income for many individuals. Platforms like YouTube, TikTok, and Instagram allow creators to share their content with a global audience and monetize their efforts through advertising revenue, sponsorships, and merchandise sales. However, building a successful online presence requires consistent effort, high-quality content, and a deep understanding of audience engagement. Affiliate marketing is another way to earn income by promoting other companies' products or services on your website or social media channels. When customers purchase products through your unique affiliate link, you receive a commission.

Finally, don't underestimate the power of personal finance management. Effectively managing your expenses, saving regularly, and avoiding unnecessary debt are crucial steps in building a strong financial foundation. Creating a budget, tracking your spending, and setting financial goals can help you stay on track. Paying off high-interest debt, such as credit card balances, can free up significant amounts of cash that can be used for saving or investing. Automating your savings and investment contributions can help you build wealth consistently over time.

In conclusion, making money is a multifaceted endeavor that requires a combination of skills, strategies, and discipline. Whether you choose to pursue traditional employment, entrepreneurship, investing, freelancing, or a combination of these approaches, it is essential to conduct thorough research, understand your risk tolerance, and seek advice from qualified professionals. By diversifying your income streams, managing your finances wisely, and continuously learning and adapting to new opportunities, you can increase your earning potential and achieve your financial goals. The key is to be proactive, persistent, and patient, and to approach wealth creation as a long-term journey rather than a get-rich-quick scheme.