Getting rich quickly before the age of thirty is a goal that resonates with many young professionals and ambitious individuals eager to escape the pressures of financial constraints and create a life of abundance. However, the pursuit of rapid wealth growth is often shrouded in myths and misconceptions that can lead to flawed strategies and long-term regret. The key to navigating this journey lies not in seeking shortcuts, but in understanding the principles of wealth creation, embracing discipline, and aligning actions with long-term financial freedom.

One of the foundational elements of accelerated wealth growth is the recognition that time is both an asset and a constraint. While the idea of quick riches may seem tempting, the reality is that financial success is rarely achieved overnight. The compounding effect of consistent saving and investing, for instance, becomes more pronounced the earlier you start. A young person who invests a modest amount in their 20s can outpace someone who starts later due to the extended period of growth. This underscores the importance of developing a habit of financial discipline early on, even if the amounts are small. The act of saving regularly, regardless of the size, reinforces financial responsibility and builds a foundation for later opportunities.

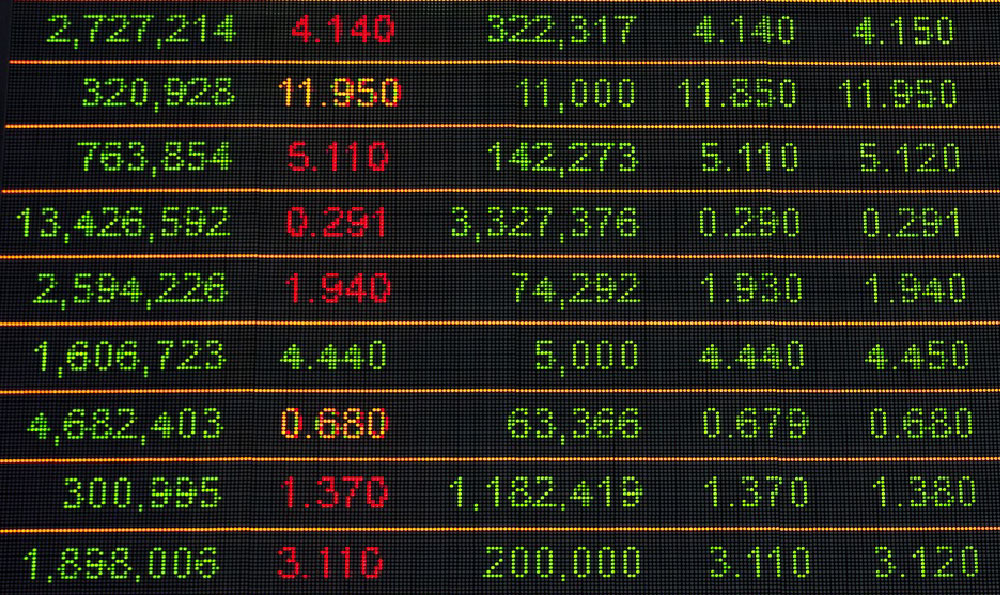

Another critical strategy involves leveraging high-impact financial instruments such as index funds, real estate, or cryptocurrencies. Index funds, for example, offer a low-cost and diversified way to invest in the stock market, which historically has provided robust returns over time. By purchasing shares in a broad market index, investors can benefit from the collective growth of thousands of companies, reducing the risk associated with individual stock picking. Real estate, on the other hand, presents another avenue for wealth accumulation through rental income and property appreciation. However, this typically requires significant upfront capital and resources, making it less accessible for those starting with limited means. Cryptocurrencies, while volatile and often misunderstood, have shown potential for exponential growth in certain scenarios, but they also carry substantial risks. A well-diversified portfolio that includes both traditional and alternative assets can help mitigate these risks while allowing for potential gains.

For those with limited capital, the power of compound interest becomes a game-changer. By consistently investing even small amounts, future wealth is amplified through reinvestment of earnings. This principle requires patience and long-term commitment, as the true value of compound growth emerges over years. For example, a person earning $30,000 annually who starts saving 15% of their income and invests it wisely can amass a substantial nest egg by their late 20s. The key here is to avoid using borrowed money for speculative investments, as debt can erode gains and lead to financial instability.

Another effective approach is to focus on acquiring high-value skills that are in demand across industries. In the digital age, skills such as coding, digital marketing, or data analysis have become highly lucrative. By investing in education or self-improvement, individuals can increase their earning potential and create multiple income streams. However, it's important to critically evaluate which skills are truly future-proof and can generate passive income or high-paying opportunities. For instance, learning a programming language can allow someone to freelance or work remotely, offering flexibility and scalability in income generation.

Entrepreneurship presents a unique path to wealth creation, but it comes with inherent risks and challenges. Starting a business requires not only capital but also a deep understanding of market trends, customer needs, and operational efficiency. For young entrepreneurs, the best strategy is to begin with low-cost ventures that can be scaled gradually. A side hustle, for example, can serve as a testing ground for business ideas without requiring full-time commitment. The crucial factor here is to validate the business model early on to avoid wasting time and resources on ventures that lack demand.

Investing in areas that exhibit high growth potential, such as emerging markets or innovative industries, can also accelerate wealth accumulation. However, this strategy demands thorough research and risk assessment. For example, a person with a strong interest in technology might invest in startups or venture capital, but these come with high volatility and the possibility of total loss. A more balanced approach is to allocate a portion of savings to high-growth opportunities while maintaining a diversified portfolio to cushion against market downturns.

One of the most underestimated strategies is to live below your means and prioritize financial independence over material wealth. By minimizing expenses and redirecting funds toward investments, individuals can create a surplus that fuels wealth growth. This requires a shift in mindset, where fulfilling basic needs is prioritized over seeking luxury, enabling more capital to be reinvested.

Lastly, maintaining a clear vision and long-term plan is essential. Quick riches are often the result of luck or timing, but financial freedom is a product of strategy and perseverance. By setting specific goals, tracking progress, and adjusting strategies as needed, individuals can stay on course toward wealth creation. It's important to remember that while quick gains may be appealing, they are often unsustainable. The true path to financial freedom involves a combination of knowledge, discipline, and patience, allowing for wealth to grow steadily over time.

In conclusion, the journey to rapid wealth growth before thirty requires a multifaceted approach that balances risk and reward, short-term and long-term objectives, and knowledge and action. By focusing on compound growth, acquiring valuable skills, investing wisely, and prioritizing financial independence, individuals can create opportunities for wealth accumulation. However, it's crucial to remain realistic, avoid unethical practices, and cultivate a mindset of long-term financial planning. The path to financial freedom is not about seeking quick riches, but about understanding the principles of wealth creation and applying them with consistency and vision.