The world of virtual currency investment has become a dynamic arena where opportunity meets complexity, offering both the potential for substantial returns and the risk of significant losses. As the market continues to evolve, understanding its nuances is critical for anyone aiming to navigate it effectively. Here’s a comprehensive breakdown of strategies, insights, and safeguards to not only generate wealth but also preserve it in this volatile landscape.

Virtual currency markets are inherently cyclical, driven by a mix of technological innovation, macroeconomic shifts, and speculative fervor. Seasoned investors often emphasize the importance of recognizing these cycles rather than fighting against them. For instance, understanding the relationship between Bitcoin's price and global inflation rates can reveal patterns that savvy traders leverage to time their entries. Similarly, observing the adoption curve of emerging projects, such as the integration of blockchain technology in decentralized finance (DeFi) or non-fungible tokens (NFTs), provides clues about long-term value retention. However, this requires a deep dive into both quantitative data and qualitative factors, such as regulatory developments or industry sentiment.

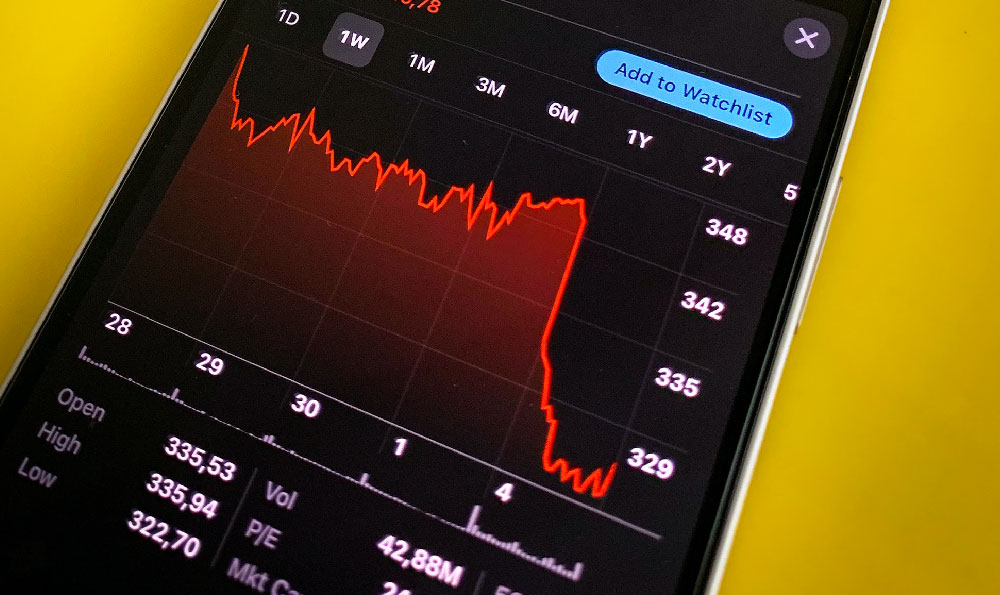

Technical indicators are indispensable tools for analyzing market behavior. While price charts alone offer incomplete narratives, combining them with metrics like the relative strength index (RSI) or moving averages (MA) allows for more precise decision-making. For example, an RSI reading below 30 often signals an overbought condition, suggesting a potential reversal in bullish trends. Conversely, an RSI above 70 can indicate overselling, presenting a buying opportunity. Investors should also pay close attention to volume patterns—sustained high volume during price surges often validates the strength of a trend, whereas a decline in volume amid rising prices may foreshadow a retracement. However, technical analysis is not a crystal ball; it should be used in conjunction with fundamental research to gain a holistic view.

Long-term investment strategies in virtual currency demand patience and a focus on sustainability. The concept of "HODL" remains a cornerstone for many who prioritize holding assets through market noise rather than frequent trading. This approach is particularly effective for projects with strong foundational technologies and active communities, as their growth tends to outpace short-term fluctuations. Diversification is another key principle, akin to traditional portfolio management. By allocating funds across multiple coins, investors mitigate the risk of a single asset's failure or underperformance. For example, balancing investments in established cryptocurrencies like Bitcoin with promising altcoins that address specific use cases—such as privacy-focused coins or institutional adoption platforms—can create a resilient portfolio. This strategy is most potent when paired with regular rebalancing, ensuring that exposure remains aligned with evolving market dynamics.

Risk management is the linchpin of any successful investment framework. A common pitfall for newcomers is overexposure to high-volatility assets, which can lead to catastrophic losses during bear markets. The solution lies in setting clear stop-loss thresholds and maintaining a diversified approach. For instance, a 5% stop-loss on individual holdings can limit downside while preserving capital for long-term gains. Additionally, liquidity management is crucial; avoiding projects with limited trading volumes can prevent locked-in losses during sudden market crashes. Investors should also consider the time horizon of their investments, ensuring that their goals align with the project's development cycle. For example, early-stage projects with uncertain fundamentals may suit those with a 3- to 5-year timeframe, whereas more mature coins cater to short-term strategies.

The psychological dimension of virtual currency investment cannot be overstated. Maintaining emotional discipline is essential, particularly in the face of rapid price swings. A useful technique is the implementation of dollar-cost averaging (DCA), where a fixed amount is invested at regular intervals, reducing the impact of timing errors. This method is particularly effective for volatile markets, as it smooths out the emotional reaction to short-term fluctuations. Moreover, resisting the urge to chase momentum—such as buying a coin after a viral social media post or a sharp price spike—requires a focus on intrinsic value rather than hype. Investors should conduct thorough due diligence, examining a project's whitepaper, team credibility, and real-world applications before committing capital.

The rise of derivative markets and staking platforms has introduced new avenues for generating income. Futures trading allows investors to profit from price expectations without owning the underlying asset, though it carries amplified risks. Similarly, staking in proof-of-stake (PoS) blockchains offers passive income by validating transactions, but requires a minimum holding period and risk of network security vulnerabilities. Leveraging these tools requires a nuanced understanding of leverage ratios, margin requirements, and interest rate dynamics, as well as the ability to assess the likelihood of market stability.

Educating oneself about market trends and technological advancements is equally vital. Attending virtual conferences, following reputable analysts, and studying case studies of successful and failed projects can provide invaluable insights. For example, the collapse of certain DeFi protocols due to smart contract vulnerabilities underscores the importance of code audits and security assessments. Investors should also monitor regulatory updates, as governments worldwide are increasingly scrutinizing virtual currency markets, which can significantly impact liquidity and legality.

In essence, virtual currency investment is a multifaceted endeavor that demands a blend of technical expertise, psychological resilience, and strategic foresight. Whether through long-term HODLing, technical analysis, or leveraging new financial tools, success lies in aligning investment goals with the market's fundamental drivers while implementing safeguards to protect against unexpected downturns. By cultivating a disciplined approach and staying informed, investors can navigate this complex terrain with confidence, turning challenges into opportunities for sustained growth.