Al Gore's financial journey is a fascinating example of how individuals, particularly those with a background in public service, can amass considerable wealth through strategic investments and entrepreneurial ventures. While he may be best known for his political career and advocacy for environmental causes, his post-vice presidency life has been marked by shrewd business decisions that have significantly increased his net worth. It's important to understand the trajectory of his wealth creation, examining the various avenues he explored and the risks he took to achieve his current financial standing.

One of the primary catalysts for Gore's financial success was his co-founding and subsequent sale of Current TV. After leaving office, Gore, along with Joel Hyatt, recognized a growing demand for user-generated content and alternative perspectives in television. They launched Current TV with the aim of providing a platform for citizen journalism and independent filmmakers. The initial years were challenging, requiring significant investment and facing skepticism from established media outlets. However, Gore's vision and his team's dedication eventually paid off. In 2013, Al Jazeera Media Network acquired Current TV for a reported $500 million. Gore's stake in the company earned him a substantial profit, estimated to be around $100 million. This transaction not only solidified his financial position but also demonstrated his ability to identify emerging trends and capitalize on market opportunities.

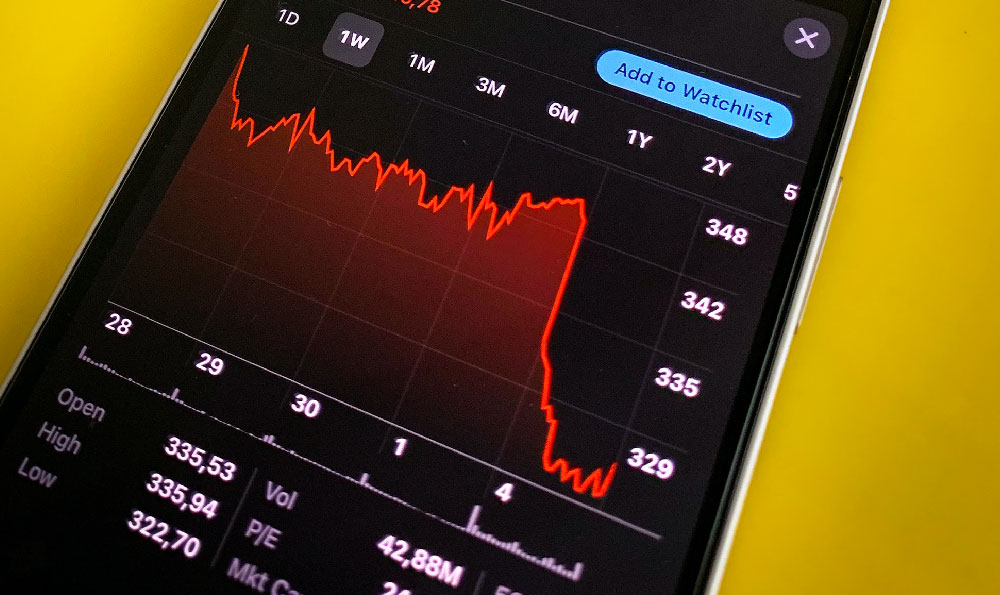

Beyond Current TV, Gore has been an active and insightful investor in the technology sector. His early investments in companies like Apple have proven to be incredibly lucrative. While the specific details of his holdings are not always publicly disclosed, it's well-documented that he recognized the potential of the tech industry early on and made strategic bets on companies that were poised for growth. His understanding of technology, coupled with his ability to connect with innovative thinkers, allowed him to identify promising ventures before they became mainstream successes. This highlights the importance of staying informed about technological advancements and being willing to invest in disruptive ideas.

Another significant source of income for Gore has been his public speaking engagements and consulting work. As a former Vice President and a leading voice on climate change, he commands considerable fees for his appearances at conferences, corporate events, and educational institutions. His speeches often focus on the urgency of addressing climate change and the opportunities for sustainable development, themes that resonate with a wide range of audiences. His expertise and experience in government and environmental policy make him a sought-after speaker, further contributing to his financial well-being. He also provides consulting services to various organizations on environmental sustainability and technology innovation, leveraging his knowledge and network to advise them on strategic initiatives.

Furthermore, Gore's involvement in the venture capital world has played a crucial role in his financial success. He is the chairman and co-founder of Generation Investment Management, a firm dedicated to sustainable investing. This venture allows him to align his financial goals with his environmental values, investing in companies that are committed to creating a positive social and environmental impact. Generation Investment Management focuses on long-term investments in companies that are addressing global challenges such as climate change, resource scarcity, and poverty. This approach not only generates financial returns but also contributes to a more sustainable and equitable future. The firm's success demonstrates that socially responsible investing can be both profitable and impactful.

Moreover, Gore has authored several books, including "An Inconvenient Truth" and "The Future: Six Drivers of Global Change," which have become bestsellers. These books have not only raised awareness about important issues but also generated significant royalties for Gore. His ability to communicate complex ideas in an accessible and engaging manner has contributed to the widespread success of his books, further enhancing his financial portfolio. The books have also led to documentaries and other media projects, further amplifying his message and generating additional income streams.

It is also essential to acknowledge that Al Gore's background and connections played a role in creating opportunities for wealth creation. His political experience and network provided him with access to influential individuals and organizations, opening doors to investment opportunities and business partnerships that might not have been available to others. While his achievements are undoubtedly attributable to his own hard work and intelligence, his privileged position certainly contributed to his success.

In conclusion, Al Gore's path to wealth is a multifaceted story involving strategic investments, entrepreneurial ventures, public speaking, and a commitment to sustainable investing. He exemplifies how individuals can leverage their expertise, network, and passion to create financial success while also making a positive impact on the world. His story offers valuable lessons for aspiring investors and entrepreneurs, emphasizing the importance of identifying emerging trends, taking calculated risks, aligning investments with values, and staying informed about global challenges and opportunities. His journey serves as an inspiring reminder that financial success and social responsibility can go hand in hand.