Banks profit from deposits through a multifaceted process involving lending, investment, and various fee-based services. The fundamental principle is simple: banks take in deposits, pay interest on those deposits (often a relatively low rate), and then lend that money out at a higher interest rate. The difference between these two rates, known as the net interest margin (NIM), is a primary driver of bank profitability. However, the reality is far more complex than this simple explanation suggests.

The core mechanism behind a bank's profit from deposits is fractional-reserve banking. Banks are not required to keep 100% of deposits on hand. Instead, they are mandated by regulators (like the Federal Reserve in the United States) to maintain a certain percentage, known as the reserve requirement, in reserve. This reserve can be held as cash in their vaults or as deposits at the central bank. The remaining portion of the deposited funds can then be lent out to borrowers, creating new money in the economy and allowing the bank to earn interest income.

This lending activity takes various forms, each contributing to the bank’s profit. Banks provide loans to individuals for mortgages, auto purchases, and personal needs. They also extend loans to businesses for working capital, expansion projects, and equipment purchases. The interest rates charged on these loans are determined by factors such as the prevailing market interest rates, the creditworthiness of the borrower, and the type of loan being offered. Banks carefully assess these factors to ensure that the risk associated with each loan is appropriately priced. The higher the risk, the higher the interest rate charged, and consequently, the greater the potential profit for the bank.

Beyond lending, banks also invest deposits in a variety of securities to generate income. These investments can include government bonds, corporate bonds, and mortgage-backed securities. These investments are chosen based on their risk-reward profiles, with banks typically diversifying their portfolios to manage risk. Government bonds are generally considered to be low-risk investments, while corporate bonds offer higher yields but also carry a higher risk of default. Mortgage-backed securities are backed by pools of mortgages and offer a yield that is typically higher than government bonds but lower than corporate bonds. The income generated from these investments contributes to the bank’s overall profitability.

Furthermore, banks generate revenue through various fee-based services associated with deposits. These fees can include monthly account maintenance fees, overdraft fees, ATM fees, and fees for specific transactions or services. While individually these fees may seem small, they can collectively contribute a significant portion of a bank's revenue, especially for retail banking operations. These fees are justified by banks as covering the costs of providing these services, such as maintaining the account infrastructure, processing transactions, and providing customer support. However, the level and transparency of these fees are often subject to scrutiny and regulation, as concerns are sometimes raised about their impact on lower-income customers.

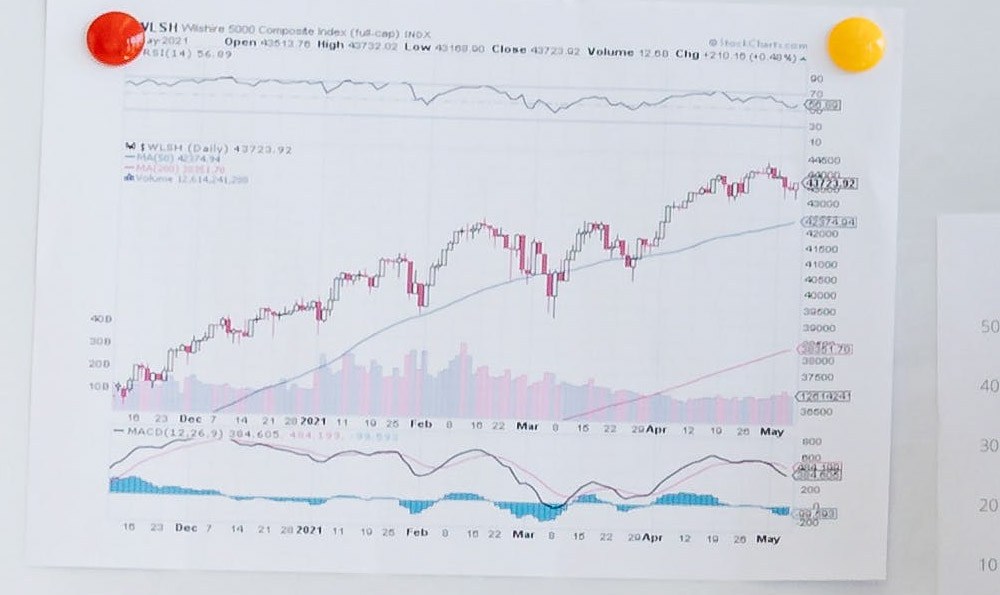

The timing of when banks profit from deposits is continuous, but the realization of those profits varies depending on the specific activity. Interest income from loans and investments is earned over the life of the asset, typically accruing daily and being recognized on the bank's income statement on a monthly or quarterly basis. Fee income is generally recognized when the service is provided or the fee is charged. The overall profitability of a bank from deposits is also influenced by macroeconomic factors, such as interest rate movements, economic growth, and inflation.

When interest rates rise, banks that have a significant portion of their assets in floating-rate loans will benefit, as their interest income will increase. However, they may also face pressure to increase the interest rates they pay on deposits, which could squeeze their net interest margin. Conversely, when interest rates fall, banks may experience a decline in their interest income, but they may also be able to lower the interest rates they pay on deposits, potentially mitigating the impact on their profitability.

Economic growth generally leads to increased demand for loans, which can boost banks' lending activity and profitability. However, economic downturns can lead to increased loan defaults, which can negatively impact banks' earnings. Inflation can also affect banks' profitability, as it can erode the real value of their assets and liabilities. Banks typically try to manage the impact of inflation by adjusting interest rates and diversifying their portfolios.

Risk management is a critical component of banks' profitability from deposits. Banks must carefully assess the creditworthiness of borrowers and manage their loan portfolios to minimize the risk of loan defaults. They must also manage their interest rate risk, ensuring that their assets and liabilities are appropriately matched to avoid losses from interest rate movements. Effective risk management practices are essential for maintaining the stability and profitability of banks.

In addition to traditional banking activities, some banks are also exploring new ways to profit from deposits, such as through fintech partnerships and the development of new digital banking products and services. These initiatives aim to attract new customers, improve efficiency, and generate new revenue streams. For instance, banks are increasingly partnering with fintech companies to offer services such as mobile payments, online lending, and automated financial advice. They are also developing their own digital banking platforms to provide customers with convenient access to banking services and personalized financial tools.

Ultimately, the success of a bank in profiting from deposits depends on its ability to efficiently manage its assets and liabilities, effectively manage risk, and adapt to the changing needs of its customers. Banks that can successfully execute these strategies will be well-positioned to thrive in the competitive banking landscape.