In the dynamic world of digital assets, the pursuit of rapid wealth growth often leads investors to explore strategies that blend innovation with prudence. The crypto market, while volatile, presents unique opportunities for those who understand its intricacies. To navigate this landscape effectively, it is crucial to adopt a multifaceted approach that balances market analysis, technical evaluation, and long-term vision. The key lies not in chasing quick wins, but in constructing a resilient framework that allows for sustainable returns while mitigating risks.

The foundation of any successful investment strategy lies in comprehending the current market dynamics. Crypto markets are heavily influenced by macroeconomic factors such as inflation rates, central bank policies, and global geopolitical events. For example, during periods of high inflation, investors often seek assets that act as hedges against currency devaluation. The scarcity of cryptocurrencies like Bitcoin, which has a fixed supply, makes them attractive in such scenarios. Additionally, advancements in blockchain technology and the adoption of decentralized finance (DeFi) protocols are driving new use cases and increasing demand for certain coins. Keeping abreast of these developments is essential for identifying potential growth areas. However, it is equally important to recognize that market sentiment can shift rapidly, fueled by social media trends or regulatory news, which underscores the need for adaptability.

Technical indicators play a pivotal role in assessing the performance of digital assets. Tools such as Moving Averages, Relative Strength Index (RSI), and Bollinger Bands help investors identify trends and potential entry or exit points. For instance, when a cryptocurrency's price crosses above its 50-day moving average, it may signal the start of an uptrend. Conversely, a high RSI reading might indicate overbought conditions, suggesting a risk of price correction. Diversifying across different asset classes within the crypto sphere—such as equities, stablecoins, and NFTs—can further stabilize returns. However, relying solely on technical analysis is risky, as it does not account for fundamental factors.

Fundamental valuation and project fundamentals are equally critical. A coin's intrinsic value is often tied to its utility, team credibility, and real-world applications. For example, Ethereum's transition to proof-of-stake and its role in smart contracts have bolstered its long-term viability. Investigating projects' whitepapers, development roadmaps, and tokenomics can reveal whether a digital asset is built for sustainability or short-term hype. Conversely, coins with unclear governance structures or speculative narratives may pose higher risks. A balanced strategy involves combining technical signals with fundamental research to avoid being swayed by market noise.

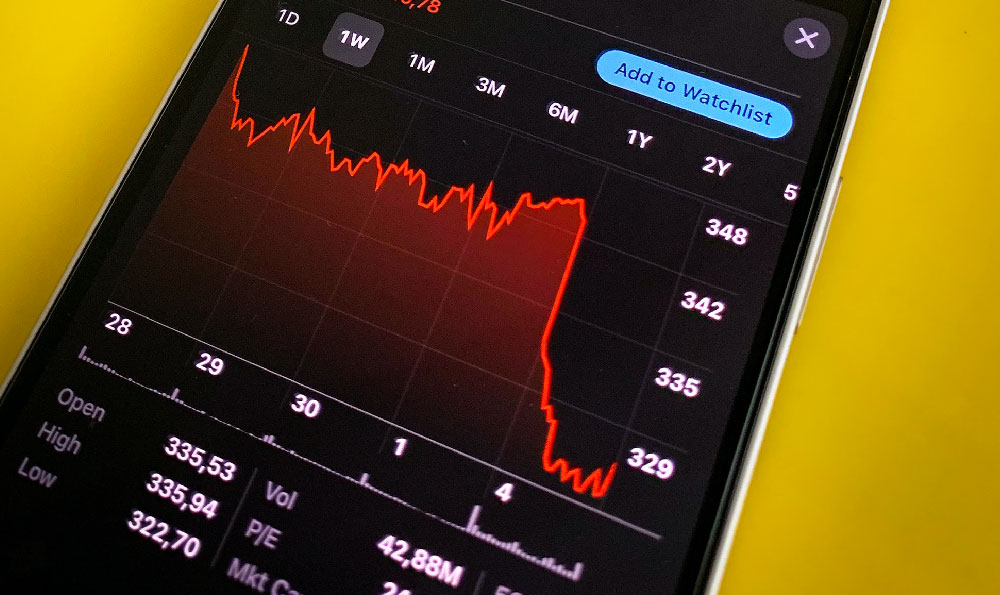

Risk management is the cornerstone of any profitable investment journey. Liquidity issues can arise in less established markets, where trading volumes are low, and price slippage is common. Investors should prioritize assets with high liquidity to ensure they can exit positions without significant losses. Market volatility is another factor; while it can lead to substantial gains, it also demands strict stop-loss mechanisms to protect capital. Diversification across multiple cryptocurrencies and asset classes, while avoiding excessive leverage, is an effective way to spread risk. Additionally, setting clear financial goals and maintaining discipline in adhering to them can prevent emotional decisions that often undermine long-term strategies.

Education and awareness are often overlooked but are vital for success. Many investors fall into traps by misunderstanding market mechanics or ignoring red flags. For instance, the rise of meme coins and pump-and-dump schemes has attracted inexperienced traders, leading to significant losses. Educating oneself on common scams, such as phishing attacks or fake exchanges, is essential to safeguard investments. Moreover, continuous learning about evolving technologies, regulatory frameworks, and market trends enables investors to make informed decisions. It is also important to recognize that short-term gains in the crypto market are often accompanied by higher risks, and long-term success requires patience and strategic planning.

Ultimately, the path to multiplying wealth through digital assets is a delicate balance between ambition and caution. Investors who embrace a comprehensive approach—analyzing market trends, leveraging technical tools, understanding fundamentals, and practicing strict risk management—are better positioned to achieve their financial objectives. However, the journey cannot be separated from personal growth and adaptability. As the crypto market evolves, so must the strategies employed by investors. By staying informed, maintaining discipline, and avoiding the pitfalls of speculative behavior, individuals can navigate this complex landscape with confidence, ensuring that their pursuit of wealth growth is both effective and sustainable. The true potential of digital assets lies not only in their ability to generate returns but also in their capacity to foster a deeper understanding of financial markets and innovation.