Okay, here's an article addressing the question of how to acquire cryptocurrency and whether direct investment is the only, or even the best, path for everyone.

Navigating the Crypto Landscape: Acquisition Methods and the Investment Imperative

The world of cryptocurrency, once a niche corner of the internet, has exploded into a global phenomenon. From Bitcoin's pioneering genesis to the thousands of altcoins that followed, crypto promises decentralized finance, innovative technologies, and, of course, the potential for substantial returns. Naturally, many are drawn to this exciting new asset class, but the question of how to obtain cryptocurrency is often overshadowed by the allure of quick profits. More importantly, individuals need to honestly assess whether direct investment, with its inherent risks, is truly the most suitable approach.

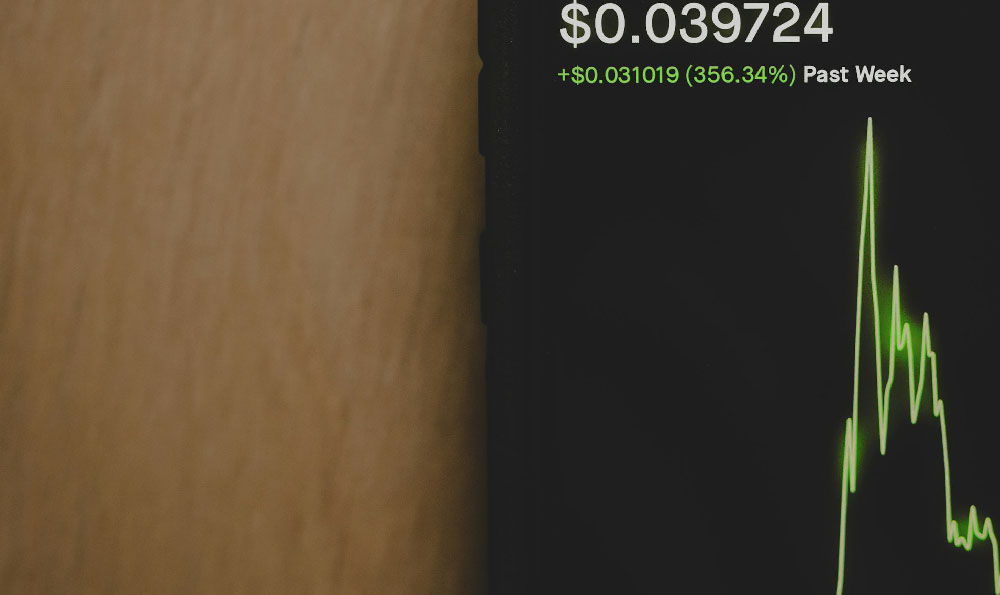

One of the most common and direct routes is through cryptocurrency exchanges. These platforms act as marketplaces where users can buy, sell, and trade various cryptocurrencies. Popular exchanges like Coinbase, Binance, and Kraken offer a wide selection of coins and tokens, along with varying levels of user-friendliness and security features. To participate, users typically need to create an account, complete a KYC (Know Your Customer) verification process, and link a bank account or debit/credit card. Once the account is funded, buying cryptocurrency is as simple as placing an order at the desired price. The inherent advantage of exchanges is accessibility; they provide a readily available entry point for anyone with an internet connection and the required identification. However, this convenience comes with its own set of challenges. Exchanges are potential targets for hackers, and the volatile nature of cryptocurrency means that prices can fluctuate wildly, leading to significant gains or losses in a short period. Furthermore, transaction fees and withdrawal limits can eat into profits, especially for frequent traders.

Beyond centralized exchanges, decentralized exchanges (DEXs) offer an alternative approach. DEXs operate on blockchain technology, eliminating the need for a central intermediary. Instead, trades are executed directly between users through smart contracts. Popular DEXs include Uniswap and Sushiswap. DEXs are generally favored by users who prioritize privacy and control over their funds, as they typically require less personal information for participation. They also offer access to a wider range of tokens, including those not listed on centralized exchanges. However, using DEXs can be more complex than using centralized exchanges, requiring a deeper understanding of blockchain technology and smart contracts. Gas fees, which are charges for executing transactions on the blockchain, can also be high, particularly during periods of network congestion. Furthermore, the lack of a central authority means that users are solely responsible for the security of their funds.

An alternative method of acquiring cryptocurrency, particularly relevant for Bitcoin, is mining. Bitcoin mining involves using specialized hardware to solve complex mathematical problems, which in turn validates transactions on the Bitcoin network and earns the miner newly minted Bitcoin as a reward. While mining was once a viable option for individual enthusiasts, it has become increasingly competitive and resource-intensive. Today, large-scale mining operations dominate the landscape, making it difficult for individuals to compete. Mining requires significant upfront investment in hardware, as well as ongoing electricity costs. The profitability of mining depends on factors such as the price of Bitcoin, the difficulty of the mining algorithm, and the cost of electricity.

There also exists the possibility of earning cryptocurrency through various online activities. Several platforms offer small amounts of cryptocurrency in exchange for completing tasks such as watching videos, taking surveys, or playing games. These opportunities, often referred to as "faucets," provide a way to acquire small amounts of cryptocurrency without risking any initial investment. While the amounts earned are typically modest, they can provide a low-risk way to learn about cryptocurrency and gain exposure to the technology. Furthermore, some companies are now paying employees in cryptocurrency, offering a direct way to earn digital assets as compensation for work.

Now, coming to the heart of the matter: is direct investment really necessary to participate in the crypto sphere? The answer, unequivocally, is no. The relentless focus on investment as the only means of engagement overlooks the profound technological shift that cryptocurrency represents. Before plunging into the potentially turbulent waters of direct investment, consider alternative avenues that allow for learning and engagement without significant financial risk.

For example, simply understanding the underlying technology of blockchain and how cryptocurrencies function can be immensely valuable. Read articles, take online courses, and experiment with blockchain-based applications to develop a solid foundation of knowledge. This understanding is crucial, regardless of whether you ultimately choose to invest or not.

Consider actively participating in crypto communities. Online forums, social media groups, and meetups provide opportunities to learn from experienced users, share insights, and stay up-to-date on the latest developments in the crypto space. These communities can offer invaluable support and guidance, particularly for newcomers.

Exploring decentralized applications (dApps) that utilize blockchain technology is another way to engage without direct investment. Many dApps offer free or low-cost services, allowing users to experience the benefits of blockchain technology firsthand. From decentralized social media platforms to blockchain-based games, dApps offer a tangible way to understand the potential of cryptocurrency beyond investment.

Ultimately, the decision of whether or not to invest in cryptocurrency is a personal one. Before making any investment decisions, it's crucial to conduct thorough research, understand the risks involved, and assess your own financial situation and risk tolerance. The cryptocurrency market is highly volatile and speculative, and there is always the potential to lose money. Starting small, diversifying investments, and seeking advice from financial professionals can help mitigate some of these risks. Remember, understanding the technology and participating in the community can be as valuable as the direct financial gains. The long-term potential of cryptocurrency lies not just in its investment opportunities, but in its capacity to revolutionize various industries and reshape the future of finance. So, engage, learn, and explore – but proceed with caution and a well-informed perspective.