Okay, I'm ready. Here's an article based on the title "ETFs: What Are They and How Can You Invest?", following your specifications.

ETFs, or Exchange Traded Funds, have become increasingly popular investment vehicles, attracting both novice and experienced investors alike. Their accessibility, diversification benefits, and generally lower costs compared to traditional mutual funds make them a compelling option for building a well-rounded portfolio. But what exactly are ETFs, and how do you go about investing in them?

At their core, ETFs are investment funds that hold a collection of assets, such as stocks, bonds, commodities, or currencies. Unlike mutual funds, which are priced only once at the end of the trading day, ETFs are traded on stock exchanges throughout the day, just like individual stocks. This intraday trading flexibility is a significant advantage, allowing investors to react quickly to market movements.

One of the most appealing aspects of ETFs is their ability to provide instant diversification. Instead of purchasing individual stocks, you can buy a single ETF that tracks a specific market index, such as the S&P 500 or the Nasdaq 100. This means that with a single investment, you gain exposure to a broad range of companies, significantly reducing the risk associated with holding only a few individual stocks. This diversification is particularly beneficial for new investors who may not have the capital to build a diversified portfolio on their own.

The creation and redemption process of ETFs is also a key factor in their efficiency and cost-effectiveness. Authorized participants (APs), typically large institutional investors, work directly with the ETF provider to create or redeem ETF shares. When demand for an ETF is high, APs can create new shares by purchasing the underlying assets held by the ETF and delivering them to the ETF provider in exchange for new ETF shares. Conversely, when demand is low, APs can redeem ETF shares by delivering them to the ETF provider in exchange for the underlying assets. This mechanism helps to keep the ETF's price closely aligned with its net asset value (NAV), preventing significant premiums or discounts.

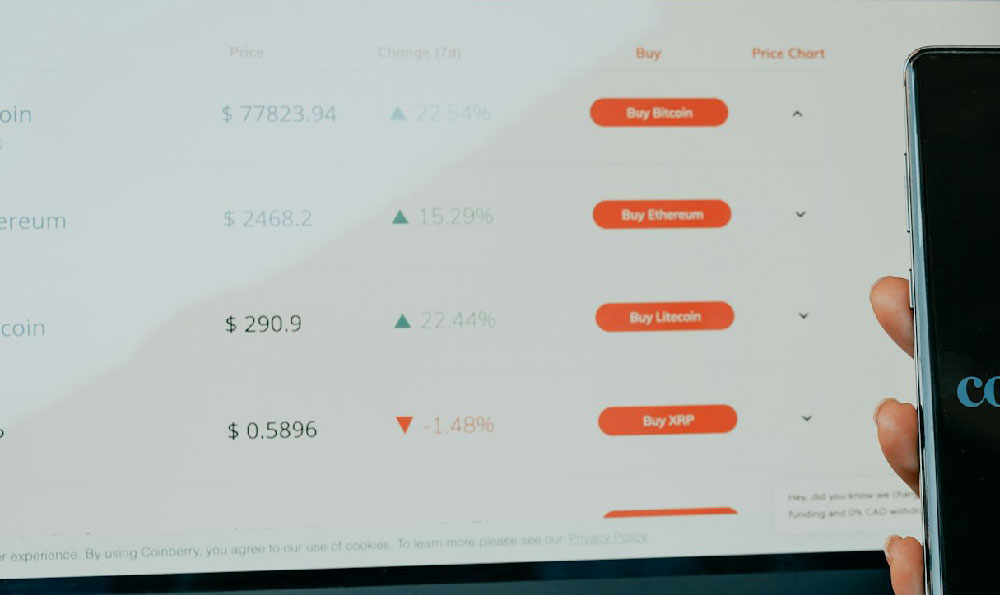

The variety of ETFs available is vast and continues to grow. You can find ETFs that track broad market indexes, specific sectors (such as technology, healthcare, or energy), specific countries or regions, different investment styles (such as growth or value), and even alternative asset classes like commodities (gold, silver, oil) or real estate (REITs). There are also specialized ETFs that employ leveraged or inverse strategies, although these are generally considered more complex and riskier and are best suited for experienced traders with a deep understanding of the underlying mechanics.

Investing in ETFs is generally straightforward. The first step is to open a brokerage account. Many online brokers offer commission-free trading for ETFs, further reducing the cost of investing. Once your account is open and funded, you can research and select the ETFs that align with your investment goals and risk tolerance. Consider factors such as the ETF's expense ratio (the annual fee charged to manage the fund), its tracking error (how closely it follows its benchmark index), its trading volume (higher volume generally means tighter bid-ask spreads), and its underlying holdings.

After selecting your ETFs, you can place an order through your brokerage account. You can choose to buy shares at the current market price (a market order) or set a specific price at which you are willing to buy (a limit order). It's important to understand the different order types and how they can impact your execution price.

When building an ETF portfolio, it's crucial to consider your investment objectives, time horizon, and risk tolerance. A young investor with a long time horizon may be comfortable allocating a larger portion of their portfolio to growth-oriented ETFs, such as those that track the technology sector or emerging markets. A more conservative investor approaching retirement may prefer a portfolio with a greater allocation to bond ETFs or dividend-paying stock ETFs.

Regularly reviewing and rebalancing your ETF portfolio is also essential. Market conditions change over time, and your initial asset allocation may drift away from your target. Rebalancing involves selling some of your overperforming assets and buying more of your underperforming assets to bring your portfolio back into alignment. This process can help you maintain your desired risk level and potentially improve your long-term returns.

While ETFs offer numerous advantages, it's important to be aware of their potential drawbacks. One concern is the potential for tracking error. While ETFs generally track their benchmark indexes closely, there can be slight deviations due to factors such as transaction costs, fund expenses, and the timing of index rebalancing. Another consideration is liquidity. While most ETFs are highly liquid, some niche or specialized ETFs may have lower trading volumes, which can lead to wider bid-ask spreads and potentially higher transaction costs.

Furthermore, it's crucial to understand the underlying risks associated with the assets held by the ETF. For example, an ETF that tracks a specific sector may be more volatile than a broad market ETF. Similarly, an ETF that invests in emerging markets may be subject to greater political and economic risks. Before investing in any ETF, it's essential to conduct thorough research and understand the potential risks involved.

In conclusion, ETFs provide a convenient and cost-effective way to diversify your investment portfolio and gain exposure to a wide range of asset classes. By understanding how ETFs work, carefully selecting the right ETFs for your investment goals, and regularly reviewing and rebalancing your portfolio, you can potentially enhance your investment returns and achieve your financial objectives. Remember to always conduct thorough research and consult with a qualified financial advisor before making any investment decisions. Investing involves risk, and there is always the potential for loss.