Okay, I'm ready. Here's an article about cryptocurrency investment, addressing safety concerns and offering guidance on how to get started.

Is cryptocurrency investment something that should be on your radar, or something you should actively avoid? That’s a question swirling in the minds of many, as the allure of potentially high returns clashes with the perceived risks of this relatively new asset class. Delving into the world of cryptocurrency requires a critical assessment of its inherent volatility, security vulnerabilities, and the rapidly evolving regulatory landscape. However, understanding these risks is only the first step. Knowing how to navigate the cryptocurrency market strategically can significantly mitigate those very risks.

The core question of safety revolves around several key elements. Firstly, the price volatility of cryptocurrencies is notorious. Values can swing wildly within short periods, influenced by everything from social media sentiment to regulatory announcements. This inherent instability makes cryptocurrency a potentially unsuitable investment for those with a low risk tolerance or those nearing retirement. If you are heavily reliant on a fixed income, putting a significant portion of your assets into crypto could expose you to significant financial risk.

Secondly, security is a paramount concern. The decentralized and pseudonymous nature of cryptocurrency transactions, while offering privacy benefits, also makes them a target for hackers and scammers. Exchanges, where cryptocurrencies are bought and sold, have been compromised repeatedly, resulting in significant losses for users. Phishing scams, malware attacks, and fraudulent initial coin offerings (ICOs) are just a few of the threats that investors must be aware of. Protecting your digital assets requires diligent security practices.

Thirdly, the regulatory environment surrounding cryptocurrencies is still evolving globally. Some countries have embraced cryptocurrencies, while others have imposed strict regulations or even outright bans. This regulatory uncertainty can impact the value of cryptocurrencies and the ability to transact with them. Changes in regulations can trigger market fluctuations, creating both opportunities and risks.

So, how can one approach cryptocurrency investment with a degree of safety and informed decision-making? The key is to implement a multi-layered strategy that addresses each of the core risks.

Firstly, understand your risk tolerance and diversify your portfolio. Cryptocurrency should typically represent a small portion of your overall investment portfolio. This diversification helps to cushion the impact of any potential losses in the cryptocurrency market. Don't put all your eggs in one basket, especially a basket as potentially volatile as crypto. Before investing anything, ask yourself: if I lost this entire amount, would it significantly impact my life? If the answer is yes, you are probably investing too much.

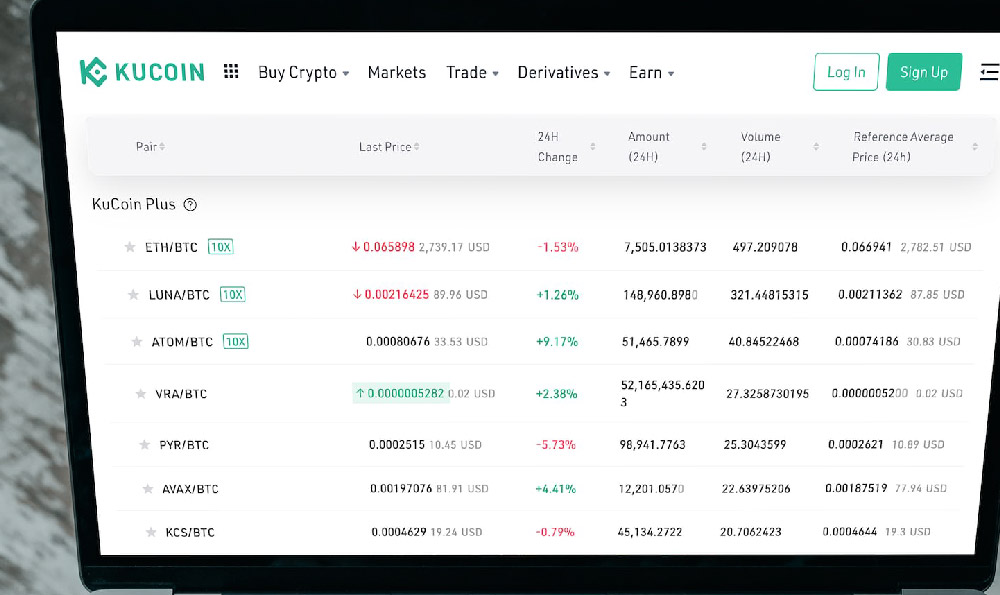

Secondly, choose reputable exchanges and prioritize security. Research different cryptocurrency exchanges and select those with a strong track record of security and regulatory compliance. Look for features like two-factor authentication (2FA), cold storage of funds (keeping the majority of assets offline), and insurance policies to protect against losses due to hacking. Never share your private keys or seed phrases with anyone, and be extremely wary of phishing attempts. Consider using a hardware wallet, a physical device that stores your private keys offline, providing an extra layer of security.

Thirdly, conduct thorough research before investing in any cryptocurrency. Don't blindly follow the hype or rely on social media influencers. Understand the underlying technology, the use case, the team behind the project, and the market capitalization. Read white papers, analyze market trends, and consult with financial advisors if needed. Look beyond the short-term price fluctuations and focus on the long-term potential of the project. Be especially wary of projects promising unrealistic returns or lacking transparency. Remember, if it sounds too good to be true, it probably is.

Fourthly, stay informed about regulatory developments. Keep abreast of the latest regulations and legal developments related to cryptocurrency in your jurisdiction. This will help you understand the potential risks and opportunities associated with investing in cryptocurrencies. Follow reputable news sources and consult with legal professionals if needed. Regulatory changes can significantly impact the value and utility of cryptocurrencies, so staying informed is crucial.

Fifthly, consider using dollar-cost averaging (DCA). DCA involves investing a fixed amount of money in a cryptocurrency at regular intervals, regardless of the price. This strategy can help to mitigate the impact of price volatility by averaging out your purchase price over time. Instead of trying to time the market, which is notoriously difficult, DCA allows you to gradually build your position in a cryptocurrency.

Finally, be prepared to lose your investment. Cryptocurrency investment is inherently risky, and there is always the possibility of losing your entire investment. Never invest more than you can afford to lose. This is a crucial principle to remember, as it will help you make rational decisions and avoid emotional trading.

In conclusion, cryptocurrency investment is not inherently safe, but it can be approached in a safer and more informed manner by understanding the risks, implementing security measures, conducting thorough research, and diversifying your portfolio. The key is to be aware of the potential pitfalls and to take steps to mitigate them. Cryptocurrency is a constantly evolving landscape, and continuous learning is essential for success. Investing with knowledge and caution is the best way to navigate this exciting, but potentially perilous, investment opportunity.