Bitcoin, the pioneering cryptocurrency, has captivated the attention of investors worldwide, promising lucrative returns but also presenting considerable risks. For beginners venturing into this digital frontier, the question looms large: Can you realistically profit from Bitcoin, and if so, how does one navigate this complex landscape?

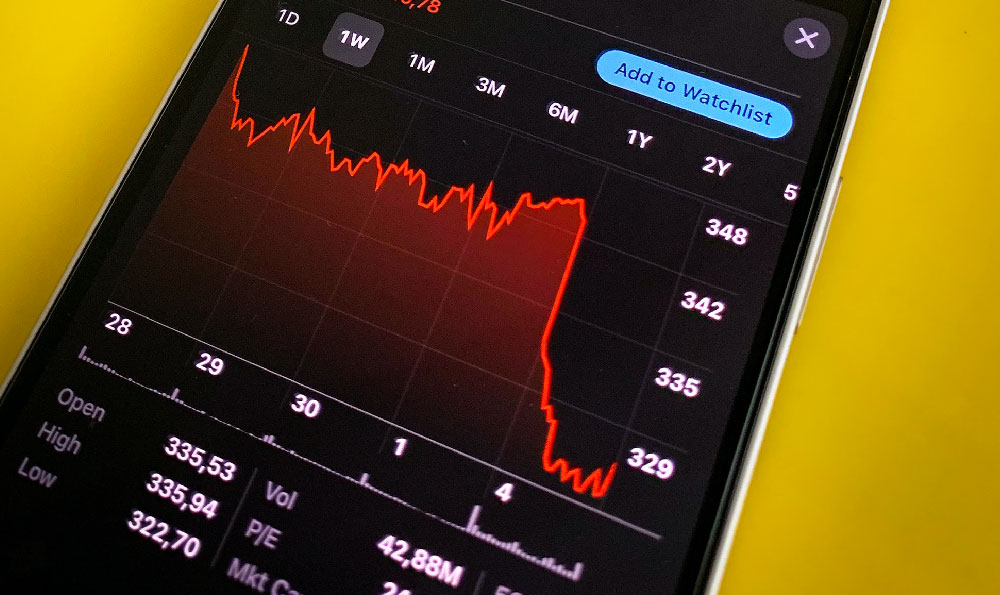

The allure of Bitcoin stems from its decentralized nature, scarcity (capped at 21 million coins), and its potential to serve as a store of value and a medium of exchange. Its price volatility, however, is a double-edged sword. While it offers the possibility of rapid gains, it also exposes investors to the risk of significant losses. Therefore, approaching Bitcoin investment requires a thoughtful and well-informed strategy.

Before committing any capital, a thorough understanding of Bitcoin and the broader cryptocurrency market is crucial. This includes grasping the underlying blockchain technology, the factors influencing Bitcoin's price (such as supply and demand, regulatory developments, and market sentiment), and the various exchanges and wallets available. Reputable resources like industry news websites, research reports, and educational platforms can provide valuable insights.

One of the primary ways to profit from Bitcoin is through direct investment, purchasing Bitcoin on an exchange and holding it with the expectation that its value will appreciate over time. This strategy, often referred to as "HODLing" (Hold On for Dear Life), requires patience and a long-term perspective. It involves weathering market fluctuations and resisting the temptation to panic sell during price dips.

However, simply buying and holding Bitcoin is not a foolproof strategy. Effective risk management is paramount. A fundamental principle is diversification. Allocating a significant portion of one's portfolio to a single asset, especially one as volatile as Bitcoin, is generally not advisable. Instead, consider diversifying across different asset classes, including traditional investments like stocks and bonds, to mitigate potential losses.

Furthermore, it's essential to determine an appropriate investment amount based on one's financial situation and risk tolerance. Only invest what you can afford to lose without jeopardizing your financial well-being. Avoid borrowing money to invest in Bitcoin, as this amplifies the risk of financial distress.

Beyond direct investment, other avenues for generating Bitcoin profits exist, although they often involve higher levels of risk and technical expertise. Trading Bitcoin, for instance, involves actively buying and selling Bitcoin to capitalize on short-term price movements. This requires a deep understanding of technical analysis, charting patterns, and market trends. Day trading, a subset of trading involving very short-term positions, is particularly risky and only suitable for experienced traders with a high tolerance for risk.

Another potential source of income is Bitcoin mining, the process of verifying and adding new transactions to the Bitcoin blockchain. Miners are rewarded with newly minted Bitcoin for their computational efforts. However, Bitcoin mining has become increasingly competitive, requiring specialized hardware (ASICs) and significant electricity consumption. Unless one has access to cheap electricity and specialized equipment, mining is unlikely to be profitable for the average individual.

Staking and lending are two newer strategies that allow Bitcoin holders to earn passive income. Staking involves locking up Bitcoin to support the operation of a blockchain network and earning rewards in return. Lending involves lending Bitcoin to borrowers through platforms that facilitate cryptocurrency lending. Both staking and lending carry risks, including the risk of platform security breaches, smart contract vulnerabilities, and borrower default.

Regardless of the chosen investment strategy, security is of utmost importance. Bitcoin wallets, which store Bitcoin private keys, are vulnerable to hacking and theft. It's crucial to choose a reputable wallet provider and implement strong security measures, such as two-factor authentication and cold storage (storing Bitcoin offline). Be wary of phishing scams and other fraudulent schemes that aim to steal Bitcoin.

The regulatory landscape surrounding Bitcoin is constantly evolving. Different countries have different laws and regulations regarding cryptocurrencies, which can impact Bitcoin's price and investment potential. Staying informed about regulatory developments is essential for making informed investment decisions.

In conclusion, while Bitcoin offers the potential for substantial returns, it also presents significant risks. Success in Bitcoin investment requires a combination of knowledge, discipline, and risk management. Beginners should approach Bitcoin with caution, conducting thorough research, diversifying their portfolios, and investing only what they can afford to lose. It's also crucial to stay informed about market trends, regulatory developments, and security best practices. By adopting a prudent and well-informed approach, investors can increase their chances of profiting from Bitcoin while mitigating the associated risks. Remember that there are no guaranteed profits, and past performance is not indicative of future results. Consulting with a qualified financial advisor is always recommended before making any investment decisions.